CMA US Registration: Know All about this for Career growth

Introduction regarding US CMA:

The CMA US registration offered by the Institute of Management Accountants (IMA) is a globally recognized and highly sought-after qualification for management accounting. This is due to the increasing need for CMAs in today's globalized world. As part of the certification process, candidates must pass both exams, but it is important to note that there are US CMA registration fees involved which can vary based on location and currency conversion rates. Nevertheless, successful completion of the program grants access to an extensive network of management accounting professionals worldwide, as well as exclusive resources and continuing education opportunities to keep up with the latest trends and best practices in the industry.

Fees & Eligibility of US CMA Registration :

Individuals who hold a Bachelor’s degree in any discipline from an Accredited College or University, or who are currently pursuing their degree, are eligible to pursue the USA CMA program. To become certified, candidates must follow a four-step process. Firstly, they must submit an application form and pay the required US CMA registration fees, providing information about their education and work experience. Secondly, they must provide official transcripts, verification of their work experience, a character reference, and successfully pass an ethics exam. Additionally, candidates must have at least 2 years of professional working experience to meet the eligibility criteria for the CMA certification. It is worth noting that candidates have up to 7 years from the date of passing the CMA exam to acquire both a Bachelor’s degree and working experience.

Exam Pattern:

CMA US registration is two paper exam. Let’s discuss the syllabus of each paper below:

- When taking the US CMA registration exam, candidates have the flexibility to choose the order in which they take Paper 1 and Paper 2. The exam is computer-based and divided into two parts. Part one focuses on financial reporting, planning, performance, and control, while part two centers on financial decision-making. The exam is administered at Prometric testing centers worldwide.

- To complete each paper, candidates have three hours to answer 100 multiple-choice questions and two essay-based questions, each taking 30 minutes. The multiple-choice questions account for 75% of the total score, covering various accounting topics such as financial statement analysis, budgeting, forecasting, performance management, and cost management.

- The essay questions, on the other hand, test the candidate’s ability to apply their knowledge of accounting principles to practical business scenarios. It is worth noting that candidates need to pay CMA US registration fees when applying for the certification process, covering the cost of exams, study materials, and administrative expenses. These fees are subject to conversion rates and may vary based on the candidate’s location.

- Furthermore, candidates must be members of the Institute of Management Accountants (IMA) to register for the USA CMA program. Membership provides access to tools, information, and peer networks to enhance their career prospects and add value to their organizations. Due to limited seating capacity at exam centers, candidates are encouraged to register early to secure their preferred exam location and date. The course duration typically ranges from 7-9 months.

Exam Windows:

It's important to note that candidates can take the exams on any working day during each window, as long as there are seats available. This allows for greater flexibility in scheduling and ensures that candidates can take the exam at a time that suits their needs.

Passing Criteria:

Candidates are required to score at least 360 out of 500 in each part of the CMA US registration exam to pass. It is important to note that candidates must complete the exam within three years of enrolling in the program and must comply with the IMA's code of ethics.

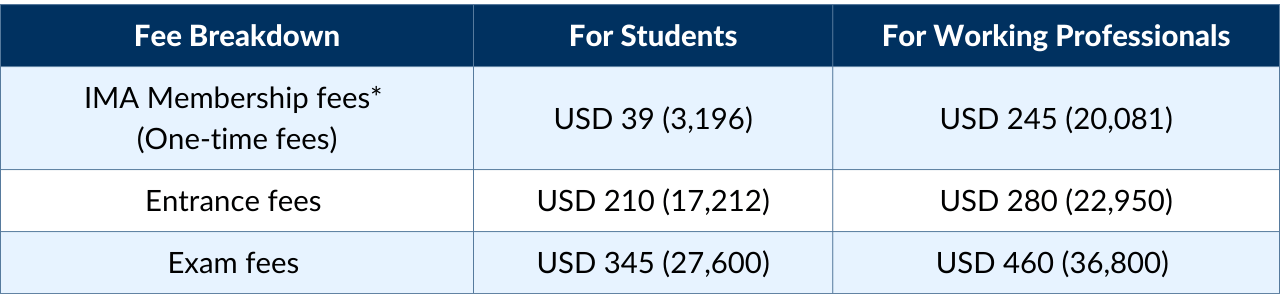

US CMA Registration Fees Structure:

Candidates who wish to register for the US CMA registration program must pay the CMA US registration fees, which are subject to change and vary based on the location of the candidate. It is worth noting that candidates may incur additional fees if they reschedule exams or register late. Moreover, becoming a member of the Institute of Management Accountants (IMA) is a prerequisite for participating in the CMA USA program. The IMA membership is mandatory and provides candidates with a wealth of benefits, including access to a global network of management accounting professionals, exclusive resources, and continuing education opportunities to stay updated with the latest trends and best practices in the field.

*It is important to mention that these fees are subject to change due to currency conversion rates.

Exam Centers in India:

The CMA US registration (Certified Management Accountant) exam is a globally recognized certification program that is open to candidates in India. Although there are registration fees involved in the USA CMA certification process, the benefits of this certification are well worth the costs. Moreover, the US CMA fees in India are affordable, making it accessible to a wide range of candidates. India has several exam centers available for candidates to take the USA CMA exam. To make it easier for candidates to find the most convenient location, here is a list of the major exam centers in India: Ahmedabad, Allahabad, Bangalore, Chennai, Dhaka, Gurgaon, Hyderabad, and Kolkata.

Note: It's worth noting that this list of exam centers in India is not comprehensive, as there may be more options available in smaller cities and towns. To select their desired exam center, candidates must pay the US CMA registration fees, which may vary based on their location due to the conversion rate. It's advisable for candidates to register early to secure their preferred exam location and date, as seating may be limited at the exam center.

USA CMA Registration & Scope in India:

For students in India seeking to build a career in management accounting and finance, the US CMA Program can offer numerous benefits, such as global recognition, job opportunities, high salaries, and convenient preparation options. However, it is important to note that there are course fees involved, which may vary depending on the chosen coaching institute or training center and the required study materials. Despite the costs, obtaining the US CMA certification can lead to new opportunities for career advancement, such as financial analyst, budget analyst, accounting manager, and more, and the investment is worthwhile as it can open doors to high-paying job opportunities and career growth in the field of management accounting.

The CMA US registration certification is highly regarded in India as it equips individuals with the knowledge and skills required to succeed in the management accounting and finance fields. The program provides candidates with access to a global network of management accounting professionals, exclusive resources, and continuing education opportunities, ensuring that they stay up-to-date with the latest trends and best practices in the field. Obtaining the US CMA certification can be a valuable addition to any management accounting or finance professional’s credentials, providing them with numerous job opportunities in India and abroad.

USA CMA Salary in India:

Earning a US CMA registration certification offers numerous benefits, including increased job opportunities, career growth, and job security. Employers highly value certified professionals and are willing to offer higher salaries compared to their non-certified counterparts.

In India, senior accountants can typically earn between 10 and 15 lakh rupees per year, while business managers can earn between 15 and 30 lakhs per year. For corporate controller positions, salaries can range from 7 lakhs per year for entry-level positions to up to 25 LPA for experienced workers.

In general, the average salary in India ranges from 5 to 7 lakh per year. Obtaining a CMA US registration certification can help professionals in India to stand out in the competitive job market, increase their earning potential, and advance their careers in the management accounting and finance fields.

Top Recruiters of USA CMA:

Here are some of the top recruiters for USA CMA in both domestic and international markets:

- Deloitte

- KPMG

- PwC

- EY

- Johnson & Johnson

- IBM

- Hewlett-Packard (HP)

- Procter & Gamble (P&G)

- Unilever

- Coca-Cola

- Philips

- TATA

- AVAYA

- Max Life Insurance

- Barclays

- And many more

These companies are known to hire professionals with a CMA US registration certification due to the rigorous training and expertise the certification provides in the fields of management accounting and finance.